Three steps to help secure your finances in 2022

As we launch into the new year, here are three steps investors can consider to help improve their financial health in 2022.

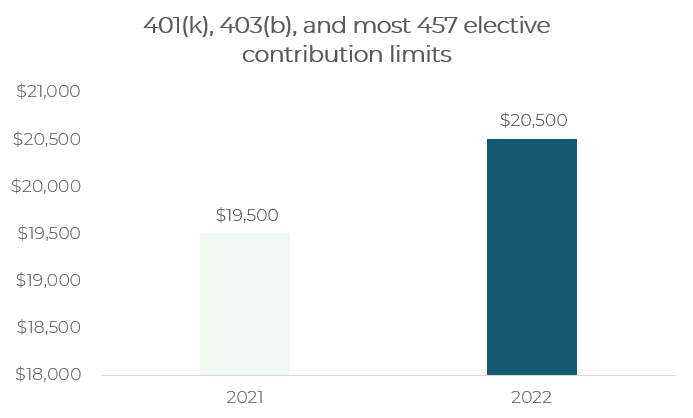

1) Take note of increased retirement contribution limits

For those utilizing 401(k), 403(b), and most 457 retirement plans, you can now elect to contribute employee deferrals of $20,500 in 2022 [1], up from $19,500 in 2021. The total limit for employer and employee contributions to 401(k) and 403(b) plans, which include company match and after-tax contributions, will increase to $61,000 in 2022, up from $58,000 in 2021.

Source: IRS

If you're looking to contribute the maximum, check with your benefits provider and make sure the appropriate percentages are withdrawn from your paycheck so your money can compound earlier.

For employers offering both Roth 401(k) and traditional 401(k) options, consider weighing towards one plan based on your current versus expected future tax brackets. For example, younger employees in lower tax brackets may benefit from skewing contributions towards the Roth 401(k) and switching over towards the traditional 401(k) later on.

2) Watch out for excess cash

As per our recent contribution in the Wall Street Journal, Americans are holding an astonishing $1.6 trillion in "excess savings" [2]. At the same time, market valuations remain high after a strong 2021, with the S&P 500 returning 26.9% for the year. Overall, investors feel paralyzed as they may be holding extra cash out of fear of dipping in this expensive and potentially more volatile environment.

While holding cash may feel safe in the short term, it causes a drag on returns while also losing purchasing power, particularly with inflation recently running at its highest level since 1982 [3]. So by definition, each dollar kept under the proverbial (or literal!) mattress is losing value each year due to rising costs for things like groceries, rent, restaurants, and gasoline.

Source: Bureau of Economic Analysis; Personal Consumption Expenditures Price Index

While investors may be apprehensive about investing in today's markets, it's important to have a clear plan for the long term.

By setting aside the right amount of cash towards what's needed for emergency funds and short term goals, investors can more comfortably allocate their remaining funds in a long term diversified portfolio.

Working with a fiduciary advisor can help quantify the right amount of cash to set aside and design a portfolio that’s tailored to meet your objectives.

3) Prepare for rising rates

With supply chain issues and labor shortages putting consistent pressure on inflation, it may be prudent to prepare for a higher interest rate environment.

Indeed, there are three rate increases expected in 2022 from the current 0-0.25% target [4], which can drive heightened market volatility in the near term. Investors allocated heavily in tech may have noticed the sector's underperformance year to date (as of January 2022), given the sector is typically more sensitive to higher interest rates.

Source: Federal Reserve. As of December 2021

While it is difficult to fully predict where interest rates will ultimately end up, building a portfolio that can withstand different economic conditions is paramount for long term success.

For example, having an allocation to real assets and floating rate fixed income can help counter the forces of inflation and rising rates, while also adding diversification to portfolios.

Additionally, shorter duration bonds may provide further insulation given that longer maturity fixed income investments are generally more sensitive to rate changes.

The Series I US savings bond is another option to consider as it provides a way to put cash aside that adjusts with inflation, which we wrote about here.

[1] IRS, Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits

[2] Wall Street Journal, ‘People Want to Start Spending Again and Inflation Is Ruining It’ (Jan 2022)

[3] Bureau of Economic Analysis, Personal Income and Outlays. (Nov 2021)

[4] Federal Reserve Summary of Economic Projections (Dec 2021)

Disclaimer: The article is for informational purposes only and is not intended to be used as a general guide to investing or financial planning, or as a source of any specific recommendations, and makes no implied or express recommendations concerning the manner in which any individual’s investments or assets should or would be handled, as appropriate strategies depend upon each individual’s specific objectives. Opinions expressed in this article are current opinions, which are not reliable as fact, as of the date appearing in this article only and are subject to change. For a comprehensive review of your personal situation, please consult with a financial or tax advisor.